Reasonable hometown tax, such failure stories "If annual income goes down..." "If you file a final tax return..." <Donburi family's money tricks> Determining the maximum deductible amount for donations Properly storing donation receipts Sukusuku Voice Ranking Edit Attention Team Chosen! Sukusuku voice

The end of this year is in sight. When you're raising a child, a year goes by in the blink of an eye.

Yoko: Come to think of it, Mr. Zaiko, did you do hometown tax?

Saiko Ah, I was so busy that I almost forgot the procedure. Every year, I'm in charge of choosing a return gift.

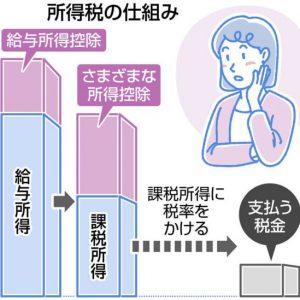

Yoko Furusato Nozei is a system where if you donate to a local government you want to support, you can deduct the amount after deducting 2000 yen from your own contribution from your income tax and resident tax. Various gifts are also popular. It feels like a good deal to receive a gift in return for a real burden of 2000 yen.

Saiko However, there were times when I failed.

Yoko What is this?

Ascertain the maximum deductible amount for donations Keep your donation receipts properly Sukusuku Voice Ranking Editing team's picks! Suku Suku Voice " title=" Reasonable hometown tax, such failure stories "If your annual income goes down..." "If you file your tax return..." (Donburi family's money tricks) Determining the maximum deductible amount of donation Donation receipt certificate Keep it neatly Sukusuku Voice Ranking Featured by the editorial team! Sukusuku Voice" >

Ascertain the maximum deductible amount for donations Keep your donation receipts properly Sukusuku Voice Ranking Editing team's picks! Suku Suku Voice " title=" Reasonable hometown tax, such failure stories "If your annual income goes down..." "If you file your tax return..." (Donburi family's money tricks) Determining the maximum deductible amount of donation Donation receipt certificate Keep it neatly Sukusuku Voice Ranking Featured by the editorial team! Sukusuku Voice" >

We found a local government that was offering the home appliances we wanted as return gifts, and in anticipation of their popularity, we took the necessary steps early. But that year her husband's work changed and her overtime pay decreased. My annual income was also lower than expected, so the amount I donated exceeded the maximum deductible amount.

Proton So the surplus was purely "donated" to the local government.

We still have money. I use a one-stop exception system that allows me to receive deductions without filing a tax return, but last year my family's medical expenses exceeded 100,000 yen, so I also filed a tax return for medical expense deductions. I didn't go through the procedure because I thought that the hometown tax payment would be handled as a one-stop exception.

Proton With the one-stop exception, if you apply to the municipality to which you donate, you will be contacted by the municipality where you live, so it is convenient to automatically receive the deduction, but it will be invalid if you file a tax return for another matter. The same applies if the recipients are more than 5 local governments.

Saiko Yes, I was relieved that I was able to hurriedly consult with the tax office and correct it. If you have filed a large amount of tax, you can request correction within 5 years from the statutory deadline, and if approved, you will receive a refund. I had a hard time finding the donation receipt...

Yoko Great deal! Sometimes you get stuck in an unexpected pitfall. Please proceed with caution this year.

Supervised by Yoko Yagi

Lives in Tokyo. She is the mother of one boy and one girl. After working for a publishing company, he became independent. After obtaining the qualification of a financial planner in 2001, he has been engaged in writing and producing money articles and conducting seminars. In 2005, he established "Kids Money Station", an organization for parents and children to learn about money and work. In 2008, he established E-Company Co., Ltd., which provides consultation services on household finances and careers. His books include “Introduction to Money from 6 Years Old” (Diamond Publishing) and “Knowledge of Money You Should Know from 10 Years Old” (Ehon Mori).

* "Donburi Family Money Techniques" will be posted on the first Friday of every month. Next time is December 3rd.

![[EV's simple question ③] What is good for KWH, which represents the performance of the battery?What is the difference from AH?-WEB motor magazine](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/b2506c4670f9f2cb45ffa076613c6b7d_0.jpeg)

![[How cool is the 10,000 yen range?] 1st: The performance of the "robot vacuum cleaner with water wiping function (19800 yen)" like Rumba is ...](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/25/5251bb14105c2bfd254c68a1386b7047_0.jpeg)