A family in the 30s who is in the red every month and is in the red.How to rebuild your household balance before your wife retires?

Image image (PIXTA)

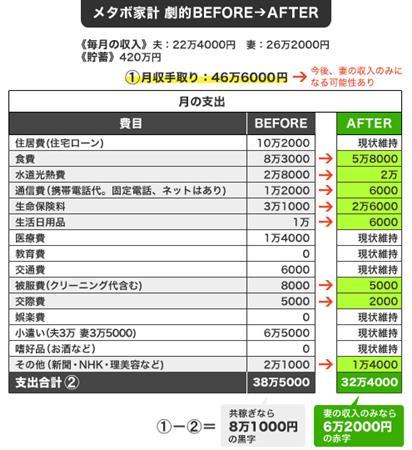

This is an FP household consultation series that professional financial planners answer the worries of money, such as households, insurance, and loans received from readers.The consultant this time is a 32 -year -old woman with two children.The situation is that too much insurance and savings are saved every month, and the salary is lost with only fixed costs.In the future, the counselor will be unemployed, but how do you rebuild your household budget?Mr. Yoshimi Ujiie will answer.[Chart] The ideal household budget and savings for a person with an annual income of 6 million yen that FP thinks, how to manage for a family of three?

[Consultant's worries]

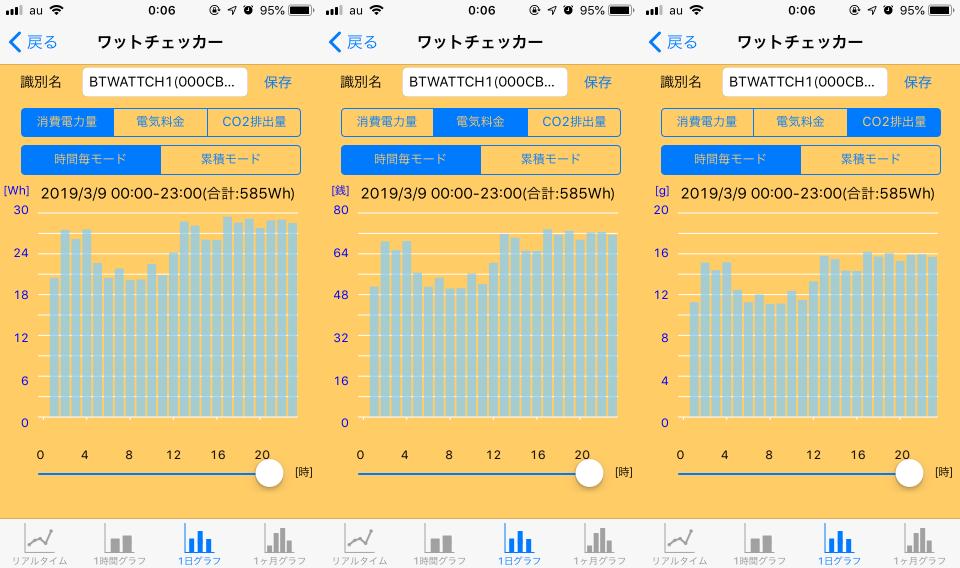

The salary is lost only with a fixed cost every month.I have an insurance and save money after retirement, but I also save 120,000 to 130,000 money a month in cash (of which 20,000 to 300,000 are used for payment of property tax).If you do not save cash, you will be worried about the purchase of the next car or the large expense when the home appliance suddenly broke.Do you have too much cash savings?Now, I have an annual income of about 2.7 million and I will be unemployed next month.I'm worried about the future.I hope I can find my work right away, but there are children and it is very difficult with Corona.[Counselor profile] ・ Women, 32 years old, company employee, married / living together: Husband / 35 years old, employee, annual income 6 million yen 2 children / (6 years old, 4 years old) His father -in -law / Retired (US farmers)+Part -time job mother -in -law / physically disabled / need nursing care * I do not support my father -in -law.・ Form of residence: Own home (detached house / Shiga prefecture) ・ Monthly household handling amount: 450,000 yen ・ Annual household handling bonus amount: 1.5 million yen ・ Aid for monthly household spending: Approximately 380,000 yenBreakdown of expenditure] ・ Housing expenses: 82,000 yen ・ Food expenses: 70,000 yen ・ Education expenses: 22,000 yen ・ Insurance premium: 70,000 yen ・ 25,000 yen ・ Vehicle expenses: 50,000 yen ・Pocket money: 38,000 yen ・ Others: 20,000 yen [Asset status] ・ Monthly savings: 120,000 yen ・ Total savings (not included in investment): 3 million yen ・ Current debt total amount: 28 millioncircle

[FP answer]

Ujiie: The consultant's household is 450,000 yen for monthly income, of which 380,000 yen (including savings insurance) saves 120,000 yen separately.380,000 yen + 120,000 yen = 500,000 yen, and the total amount is higher than the income of the income, so while saving savings, the balance of the savings account has decreased, and the balance is compensated for the decreased balance during bonuses.It seems to be in a state.Such households are sometimes seen when they have a household diagnosis, but they are not very clean.Reduce your monthly savings from 120,000 yen to 70,000 yen to 50,000 yen to eliminate the monthly deficit.Since the monthly deficit is no longer needed, at the time of the bonus, it is possible to increase the total of 600,000 yen in total, 50,000 yen x 6 months = 300,000 yen, twice a year.

次ページは:共働きの妻が会社を辞めると家計はどうなる?最終更新:MONEY PLUS

![[EV's simple question ③] What is good for KWH, which represents the performance of the battery?What is the difference from AH?-WEB motor magazine](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/b2506c4670f9f2cb45ffa076613c6b7d_0.jpeg)

![[How cool is the 10,000 yen range?] 1st: The performance of the "robot vacuum cleaner with water wiping function (19800 yen)" like Rumba is ...](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/25/5251bb14105c2bfd254c68a1386b7047_0.jpeg)